Everything You Need To Know In One Easy To Read Graph!

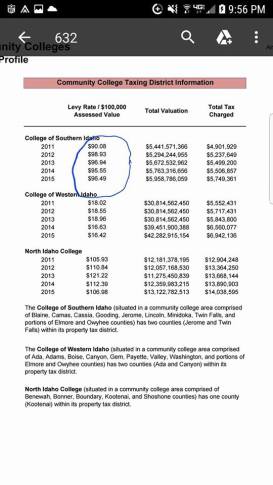

The graph below is from the Idaho Legislative Budget Book, 2017, page 1-67. It shows some key historical taxing information for the 3 Community Colleges currently in Idaho. The first column shows what taxpayers are paying for each $100K in taxable property they have. The second column lists the taxing district's total taxable value. The third column lists the total property tax the respective Community College requires from the local property tax payers to simply break even.

Note that the total property tax that all 3 Community Colleges take in continues to go up each year, even when two of the colleges have had sharp enrollment declines.

Please also realize that while CWI has had a small decrease in taxes for each $100K in taxable property that is simply because their tax base has exploded in value in the Boise valley areas that comprise their taxing district.

Indeed, if a college that needed $6.9 million in property taxes like CWI does, if that was in Bonneville County with our current tax base of just over $6 Billion, our yearly porperty tax would be roughly $110 per $100K in taxable value. This $110 new tax each year would be in line with what other taxpayers pay in Twin Falls and Kootenai Counties, and what we can expect to pay, most likely in the first year of the taxing district when the appointed board can set the first year tax rates much higher than a wishful estimate of $13 for the average homeowner. See this chart below. It could be similar for us.